Behavioural investing biases can have a strong influence on the way people think and act when dealing with their own money, often making them more prone to systematic errors. They are often driven by emotions rather than a reliance on facts and logic - like reducing the mental pain that accompanies a short-term loss from a dip in the stock market by selling investments. Alongside the financial expertise of advisers, the problems caused by investing biases are a strong reason to seek advice.

Everyone is influenced by emotions to some extent. It doesn't matter how rational we think we are, behavioural experiments show that people often make irrational decisions under uncertain conditions - just like those commonly found in investing. By making decisions driven by emotional impulse rather than an understanding of stock market history, investors can sabotage their route to building long-term portfolio wealth. Common behavioural investing biases include herding, anchoring, and short-termism, which we highlight in this article.

The good news is that ‘outsourcing' investment decisions to an adviser can be one of the best defences investors can make against the emotional traps that come with investing your own money. But it's not the complete answer as clients can panic and question adviser strategies in volatile times. In our Investor Confidence Barometer Survey (Q2 2023) advisers told us that 44% of their clients had initiated contact with them to discuss market volatility in the previous 12 months. Moreover, the average adviser reported that 45% of their clients have strong views on asset allocations. However, it is the fact 63% of advisers told us that they are frequently or regularly surprised by their clients' investment proposals that is particularly worrying.

Behavioural biases can be financially damaging for investors and frustrating for advisers to see in their clients. In fact, 95% of advisers believe that emotional decisions cost their clients at least 2% pa in foregone returns.

It's clear from these survey results that those advisers who can build a deeper understanding of behavioural biases and the practical workarounds that mitigate them, can help their clients build vital staying power in volatile markets. We feel this ongoing guidance, allied with a risk profiled, robust long-term investment strategy, can increase the likelihood that investors achieve their financial goals.

Why is Consumer Duty so important?

The FCAs Consumer Duty legislation makes specific mention of accounting for consumers' behavioural biases. Advisers are encouraged to analyse the customer journey from beginning to end, identify key behavioural investing biases, conflicts, frictions, and misconceptions. This can be used to build a more complete client profile that enables the adviser to recommend the most appropriate options, which should ultimately result in good client outcomes in line with the Consumer Duty's principles.

Three common behavioural investing biases

Behavioural investing biases are generally latent, and their influence subconscious during stressful or emotional times, so investors are seldom aware of their true power. This is where advisers can help. Here, we highlight three common biases and workarounds that advisers can use with their clients

What does it mean? Following the crowd and the fear of missing out.

What does it mean? Following the crowd and the fear of missing out.

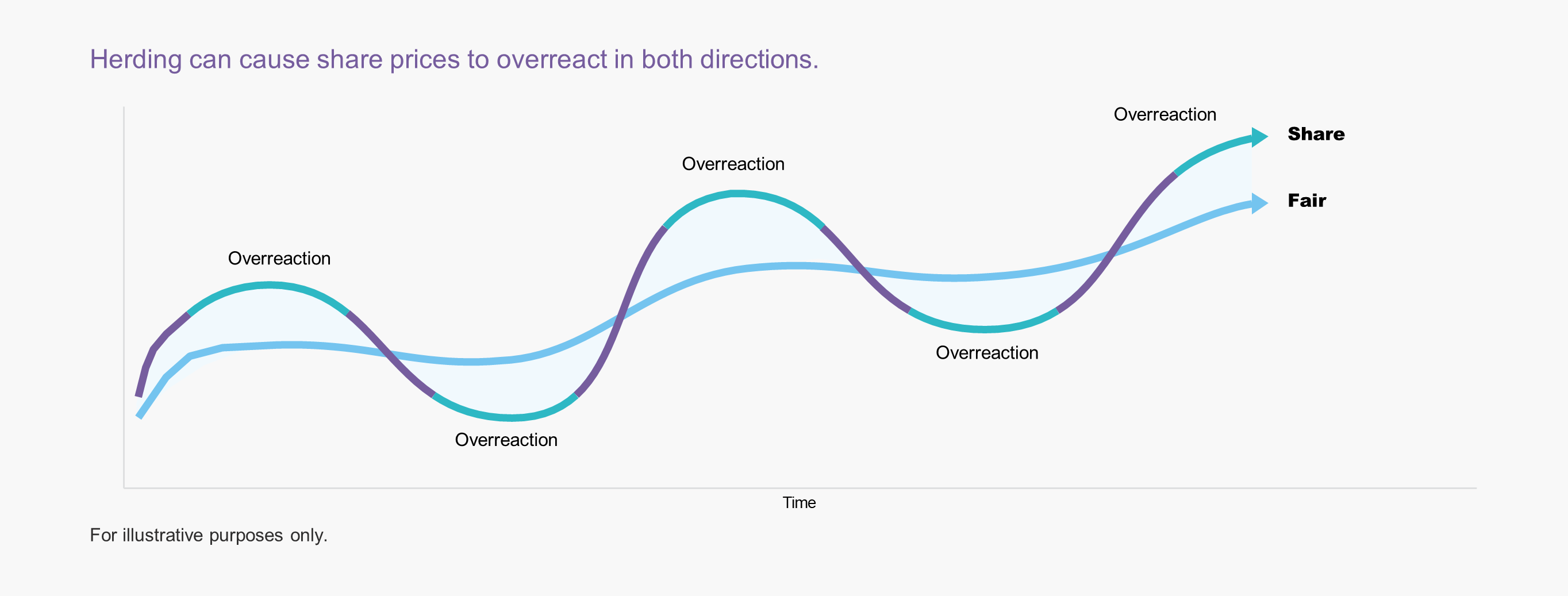

Herding in financial markets pushes up the values of sectors or stocks causing bubbles. Humans are naturally prone to herding and investing is no different. Investors feel safer doing what everyone else seems to be doing - especially if they are enjoying financial gains - it's called FOMO - the fear of missing out.

Why is it a problem? It's not always rational and could backfire.

Why is it a problem? It's not always rational and could backfire.

Investing with the crowd can be useful early-to mid-cycle but it is unfortunately much more prominent in the late cycle, when prices are already higher, as seen below for illustrative purposes only. Herd behaviour happens when investors begin to blindly follow others rather than making independent decisions based on financial data. This collective sentiment can cause extended rallies and sell-offs driven by greed and fear, where prices move away from fair values. An investor's inclination to follow the herd may not align with their risk profile, capacity for loss or their long-term goals.

How can its impact be reduced? Be more contrarian and use pound cost averaging.

How can its impact be reduced? Be more contrarian and use pound cost averaging.

By committing to a long-term, multi-asset strategy that takes accounts of market cycles and herd psychology, the negative impact of herding in ‘hot' sectors or stocks can be appropriately diversified and managed. This helps to avoid the regret associated with putting too much capital into one sector if that sector subsequently underperforms. By using a pound-cost averaging approach, investors can avoid falling prey to the trap of committing lump sums to the market at the height of a bubble. Alternatively, advisers can also encourage a contrarian approach of making additions during corrections and banking some profits after euphoric rallies. This can be achieved by setting up a contingent contract with buying and selling at pre-agreed market valuation or price levels.

What does it mean? Sub-conscious attachment to numbers.

What does it mean? Sub-conscious attachment to numbers.

Anchoring is when investors focus on or become fixated on current variables and numbers that are not particularly useful for future investing. For instance, fund prices, fund returns, stock market levels, and total account or pension fund sizes can become psychological anchor points - however, they are just snapshots in time that offer little relevant information about the future.

Why is it a problem? Can result in perceived losses and an unhelpful focus on the past.

Why is it a problem? Can result in perceived losses and an unhelpful focus on the past.

Many pension funds have hit high watermarks in recent years, which can act as psychologically important levels even though they are consigned to history. When investors then experience a decline in their accounts from a high watermark, another bias called loss aversion can come into play, where the pain from a perceived loss is generally felt much greater than the pleasure from a similar-sized gain. For this reason, the anchoring to the high watermark level of an index or a fund is not particularly useful for investing. Share prices and market levels are poor anchors in the short-term as sentiment can move prices away from fair value. Stock and market valuations versus historical averages may offer more insightful information about future returns.

How can its impact be reduced? Rely on useful anchors like risk ratings and withdrawal rates.

How can its impact be reduced? Rely on useful anchors like risk ratings and withdrawal rates.

Advisers should be wary of reporting high watermark levels in funds or market indices or measuring performance

in this context as it can encourage anchoring and the perceived pain of a loss. The adviser can also anchor and re-centre the client via a reappraisal of the risk-rating, a discussion of historical asset returns and by re-focusing on the long-term investment outcome. If the pension is in drawdown, the most useful number advisers can encourage clients to anchor upon is the withdrawal rate.

What does it mean? Excessive focus on short-term results.

What does it mean? Excessive focus on short-term results.

The phrase ‘short-termism' is exactly what it says on the tin. Human beings are naturally attracted to options that provide immediate results or instant gratification. It's a reason why people often prefer to spend now rather than save later into a pension, where the reward for doing so is far off in the future.

Why is it a problem? A short-term mindset with long-term investing can be a mismatch.

Why is it a problem? A short-term mindset with long-term investing can be a mismatch.

Short-term investing behaviour can be chaotic, and tension filled, always looking for the next entry or exit point fora short-term gain, and the fear of missing out. Short- termism can show up with investors taking too much risk to make short-term gains or, more commonly, by reducing risk to avoid the pain that comes with short-term losses, especially during market volatility. Both scenarios are detrimental to achieving long-term investment goals.

A short-term mindset leaves investors wide open to the strong emotions that accompany short-term market volatility and cyclical peaks and troughs. During market corrections, clients can also become excessively focused on short-term returns rather than the bigger picture.

How can its impact be reduced? Take a more considered long-term approach.

How can its impact be reduced? Take a more considered long-term approach.

Volatility is a feature of investing not a bug. History shows that each market downturn is typically followed by an upturn, so it makes sense to focus on long-term outcomes by staying invested and avoiding timing the markets. Building long-term wealth is all about time in the markets not timing.

One practical way for advisers to encourage a longer- term mindset in their clients is to frame performance in reverse in client reports, and present the bigger picture by prioritising long-term returns. This can help to avoid a damaging short-term focus.