With more consumers turning to artificial intelligence (AI) as well as social media to guide everyday decisions, it's no surprise that OpenAI’s ChatGPT is increasingly used to search for financial advisers.

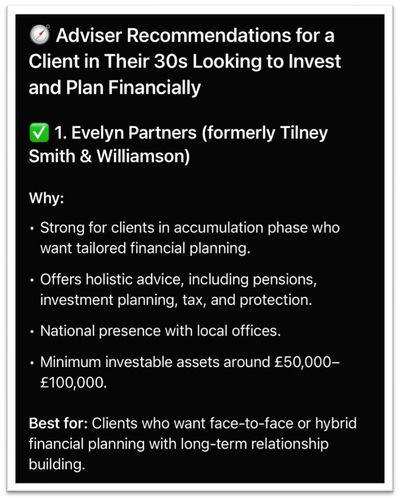

PA explored which UK wealth managers and financial planning firms ChatGPT has recommended to a client in their 30s with £100,000 to invest, seeking either long-term advice or one-off financial planning.

The results were telling. The chatbot surfaced firms with national footprints, hybrid servicing models, and strong digital presences.

The firms ChatGPT recommends

Here is the full list of advice firms ChatGPT recommended based on preferences.

The firms mentioned for long term advice and face-to-face meetings were:

- Evelyn Partners

- Netwealth

- RBC Brewin Dolphin

- True Potential Wealth Management

- Mazars Financial Planning

- Chase de Vere

- Paradigm Norton

- EQ Investors

For one-off guidance with hybrid servicing:

- First Wealth

- Hatch

- Octopus Money

- Rosecut

- Eldon Financial Planning

- Fintuity

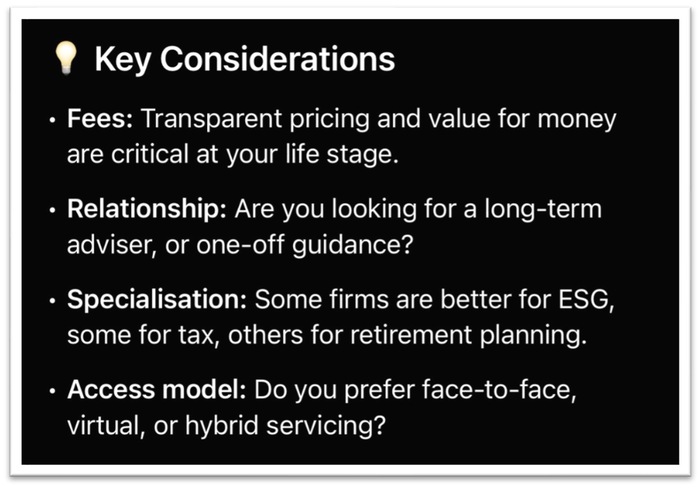

ChatGPT also asked the user follow up questions such as "are you looking got a long-term adviser?" and "do you prefer face-to-face?".

When asked to provide a list of firms offering one-off financial planning, ChatGPT recommended First Wealth because of its "strong focus on goal setting and life planning without product push" and the option to later return to financial planning sessions "without pressure".

ChatGPT also gave further details on First Wealth's offerings such as one-off, fixed fee financial planning sessions and hybrid servicing such as video meetings, digital onboarding and planning tools.

It also mentioned that First Wealth is a Chartered and award-winning firm.

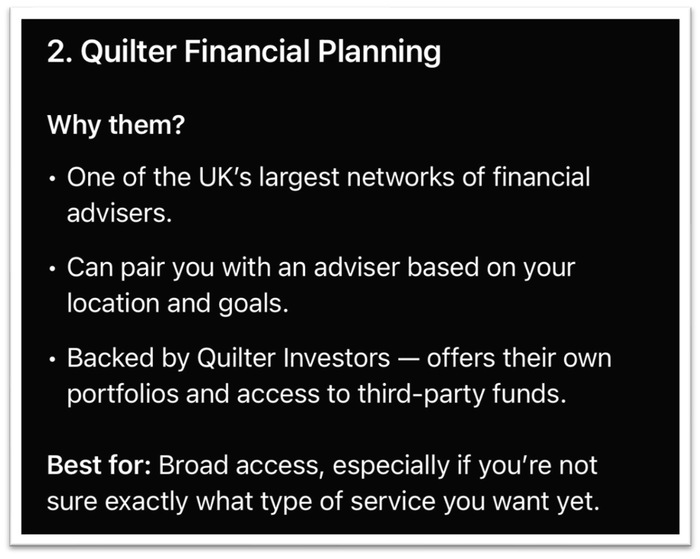

Featuring in ChatGPT's suggestions on one day or in response to one prompt was no guarantee that firms would be always be included in its recommendations. When responding to the same prompt on a separate day, ChatGPT recommended firms that were not on the original list, such as Quilter Financial Planning, Bowmore Financial Planning, Financial Framework Wealth & Estate Planning, and Flying Colours.

What AI sees versus what it misses

Philip Calvert Consulting founder Philip Calvert told PA that tools like ChatGPT "tend to surface firms with a strong and consistent digital footprint".

"That means those with robust SEO strategies, a steady stream of authoritative and relevant online content, and clear signals about their expertise and specialisms."

In other words, if Google does not know who you are, then ChatGPT probably will not either. This creates a visibility gap between large, well-resourced firms and smaller or boutique players who may have an excellent reputation offline but little digital exposure.

"AI systems can unintentionally amplify firms whose marketing language is clearer, simpler and better structured," Calvert added. "A dense or overly technical online style can leave even high-quality firms underrepresented."

EQ Investors, one of the firms surfaced by ChatGPT, confirmed this effect. EQ Investors marketing director Ben Faulkner told PA that the firm had spoken to at least two prospects who found the firm via ChatGPT – one of whom went on to become a client.

"Our SEO and digital presence both influence our visibility in AI tools like ChatGPT. You can see from AI search results in Google that it's drawing information from our website, award successes, national newspaper coverage, and events we've sponsored," he said.

According to Calvert, there are three practical steps firms can take to become more visible in AI search results:

- Use natural, human-centred Q&A content on your website.

- Answer the common questions potential clients ask, in plain English.

- Highlight trust signals like testimonials, case studies, and credentials.

- Structure your information clearly, using headings, subheadings and simple page layouts that are easy to interpret.

But even if your firm appears in AI tools, that does not automatically translate to new clients. Calvert advises using lead magnets like digital scorecards or conversational AI assistants to build trust and capture client interest at the right moment.

Avenir chief commercial officer and co-founder Andrea MacDonald told PA that AI tools like ChatGPT are becoming the first port of call for digital-savvy investors, particularly younger generations.

"As trust in conversational AI grows, it's becoming a first port of call for early-stage research, much like Google has been for the last couple decades," she said. "Users might not rely solely on ChatGPT to choose an adviser, but they are using it to shortlist firms, compare approaches, and understand what to expect."

She warned that AI typically pulls from highly visible and frequently referenced sources, which gives larger firms a head start. For smaller firms to compete, they must invest in high-quality content, be listed on credible third-party sites, and maintain consistency across all digital channels, from websites to LinkedIn to Google Business listings.

"It's no longer just about doing excellent work," MacDonald said. "It's about making sure digital ecosystems, including AI, can see and understand that excellence."

Faulkner said EQ Investors has begun tracking their visibility across AI platforms and search engines to monitor changes over time. "Younger investors recognise the importance of sustainability issues, the impact of their investments, and a desire to make a difference, we feel well placed in terms of that, but you can't stand still," he said.

The future of AI in advice

The Financial Technology Research Centre founder Ian McKenna believes tools like ChatGPT are becoming part of the advice-seeking journey, especially for younger clients. "ChatGPT is recommending large firms over boutique. The question is whether smaller firms are investing as much as they should," he told PA.

McKenna added that strategic investment in digital presence often depends on where firms are in their business lifecycle: "If they're looking to exit in the next two or three years, they may assume the next person will make those investments. The more important thing is that the smart firms are doing this."

He also cautioned advisers not to overreact: "I wouldn't be too worried about clients using ChatGPT."

Supporting research

UK-based research supports these insights. According to a 2024 Barclays Digital Confidence Survey, nearly one in five UK adults (18%) say they would consider using AI tools like ChatGPT to help with financial decisions, rising to over 30% among those under 35. Similarly, a 2023 study by the Financial Conduct Authority on consumer investment habits found that younger investors were more likely to rely on digital sources and tools before contacting a financial adviser.

Meanwhile, The Lang Cat's 2025 State of Advice report noted that while 82% of advice clients still value human contact, 18% of advisers now see AI tools as useful for initial triage and discovery, a jump from 0% the year before. The report attributed this shift to improved consumer understanding of AI and its time-saving potential.

According to the 2025 Investor Index, conducted by AML Group and The Nursery, 77% of UK investors believe that ChatGPT could provide reliable financial advice. The survey was based on responses from 1,100 UK adults (18+) with at least £10,000 invested and also found that ChatGPT usage among UK investors has risen by 11 percentage points to 33% in the past year. Among younger investors aged 18 to 34, that number soars to 70%.

The financial advice discovery journey is clearly changing. Tools like ChatGPT are acting as the new front door to the profession, shaping client expectations and steering them toward firms that know how to be seen online. For many advisers, this means that digital visibility is no longer optional, but an advantage.