Key points

- US economy showing signs of cooling but an additional rate rise still seem likely.

- Weak data, especially from Germany, hints at extended euro-area recession.

- UK core inflation still on the ‘sticky' side despite slide in headline numbers.

- Slowing economic momentum in China suggests further stimulus measures needed.

Interest rate rises appear to be having the desired effect but there is still work to be done to bring inflation down in the US and Europe, unlike in China where more policy measures to support activity may be needed.

United States - Recent inflation and labour market reports suggest some cooling in the economy.

Consumer price inflation was 3% in June compared with a year earlier, down from 4% in May. Core inflation, which excludes volatile food and energy prices, was 4.8% year-on-year, lower than May's 5.3% reading. We caution, however, that the path towards 2% inflation is likely going to be long and winding. We expect core inflation to finish 2023 at around 3.3% compared with a year earlier, and for year-on-year core inflation not to fall below 2% until 2025.

The 209,000 non-farm jobs created in June was also the lowest number since December 2020. But wage growth remains strong, with average hourly earnings up 4.4% year-on-year.

We believe that gives the US central bank, the Federal Reserve, the impetus to raise its main policy interest rate target by 25 basis points when it meets on 26 July. This will take it to a range of 5.25%-5.5%, which is also our year-end forecast range.

Euro area - Recent revisions to euro area data show that the economy contracted by 0.1% in both the fourth quarter of 2022 and first quarter of 2023. Weak recent activity, especially in Germany, suggests another mild quarterly economic contraction, which would extend the region's recession into a third quarter.

We expect recent interest rate rises to have the biggest impact in the second half of 2023, with the labour market weakening as the European Central Bank (ECB) continues in its quest to bring inflation down to its 2% target.

Vanguard continues to expect full-year GDP growth of 0.5%, though the risks are now skewed to the downside. The pace of headline inflation slowed to 5.5% in June compared with a year earlier, down from 6.1% in May. Core inflation - which excludes energy, food, alcohol and tobacco prices - picked up to 5.5% from 5.3% in May.

We believe that still-too-high inflation will lead the ECB to raise its deposit facility rate by a further 25-50 basis points to a terminal rate of 3.75%-4%, with no rate cuts until mid-2024.

United Kingdom - A sharp fall in the annual rate of inflation to 7.9% in June from 8.7% in May has naturally grabbed attention. But strip away volatile food, energy, alcohol and tobacco prices and it's clear that core inflation remains a concern. After an unexpected rise in core inflation to a more-than-three-decade high of 7.1% in May, data showed only a slight dip to 6.9% in June.

Vanguard expects year-on-year core inflation to end the year at around 4.9% and to average 5.3% in the fourth quarter, which means the Bank of England (BOE) still has work to do to get inflation down towards its 2% target.

We expect interest rates to peak at 5.5%-5.75%, given the stronger-than-expected inflation data, a still-tight jobs market, and accelerating wage growth. We maintain our view of no rate cuts until mid-2024 at the earliest.

Our base case is for recession in 2023, though the likelihood has increased that recession may be delayed into 2024.

China - The economy grew by 6.3% in the second quarter compared with a year earlier, but that was a full percentage point below what the expert consensus had been expecting. Compared with the first quarter, it grew by only 0.8%.

Vanguard recently lowered its full-year growth forecast to a range of 5.5%-6%. The slowing growth momentum in the second quarter was largely attributable to a delayed and insufficient policy response to the economic challenges. Uncertainties around meaningful policy stimulus pose a downside risk not only to our forecast but also to the government growth target of "around 5%."

We anticipate further stimulus measures to remain relatively modest. That could take the form of expanded policy bank financing for high-end manufacturing and the green sector, a modest policy rate cut and a further relaxation of housing purchase restrictions.

The points above represent the house view of the Vanguard Investment Strategy Group's (ISG's) global economics and markets team as of 19 July 2023.

Asset-class return outlook

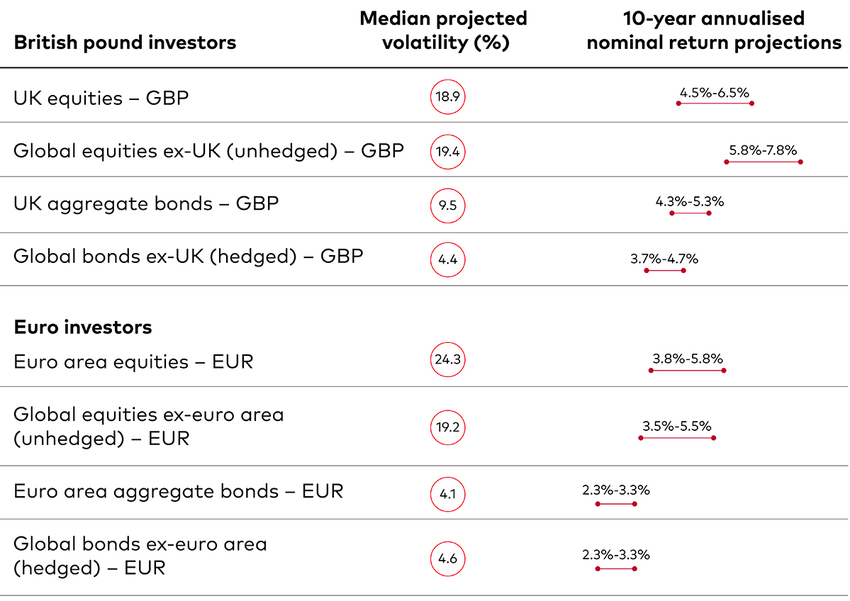

Vanguard has updated its 10-year annualised outlooks for equity and fixed income returns based on a 31 May 2023 partial running of the Vanguard Capital Markets Model® (VCMM).

Our 10-year annualised nominal return projections, expressed for local investors in local currencies, are as follows1.

[1] The figures are based on a 2-point range around the 50th percentile of the distribution of return outcomes for equities and a 1-point range around the 50th percentile for fixed income. Numbers in parentheses reflect median volatility.

IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of 31 May 2023. Results from the model may vary with each use and over time. For more information, please see the ‘Investment risk information' section.

The Vanguard Tough Mudder Takeover

For one day only, Vanguard will be taking over the famous Tough Mudder 5km course, to bring you, your colleagues and your peers an active day out like no other. Featuring 13 teamwork-inspired muddy obstacles jam-packed into one action-packed course, challenge yourself and your colleagues and make The Vanguard Tough Mudder Takeover your next team day out. And the best part? It's all on us.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard's primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this article is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this article does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this article when making any investment decisions.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.