Investing is about striking the right balance between risk and return, but that's easier said than done. Across our multi-asset funds, we use a range of tools to find that balance. Some, like equities and bonds, are well known. Others, like hedging, are less familiar and often misunderstood. Far from a risky black box, hedging, when used thoughtfully, can help reduce risk without diluting returns.

Put simply, hedged equity lets us invest in businesses we like, even in markets we don't.

When we find attractive individual opportunities but have concerns about the broader return outlook for the market in that country, we can hedge some of the exposure primarily using index futures.

Hedging 101

At its core, hedging involves two things: taking on an investment position with certain risks, and then taking another position to offset some of those risks. For us, the relevant risk we seek to offset is stockmarket exposure.

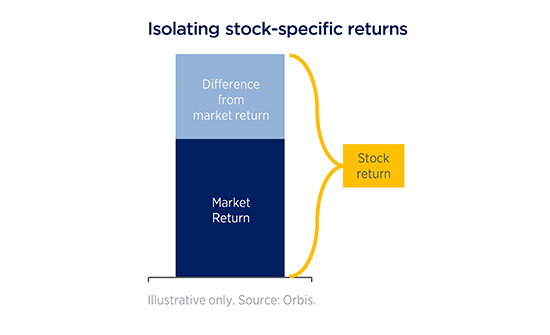

When you buy a stock, you can think about its return in two parts: the market return, and the difference between the stock's return and that of the market. What hedging lets us do is strip out the market return, so that we're left with just the difference between the stock and the market.

Source: Orbis Investments, for illustrative purposes only

We buy the stock we like, then sell (short) the market using index futures contracts. In essence, we agree to sell the market at some point in the future, at a set price agreed today. If the market goes up between now and the agreed date, it will be more expensive for us to deliver what we promised, so we'd lose money on the contract. Conversely, if the market were to go down, we would make money, as we'd locked in the higher selling price but would be able to deliver the market more cheaply.

The importance of picking the right stock

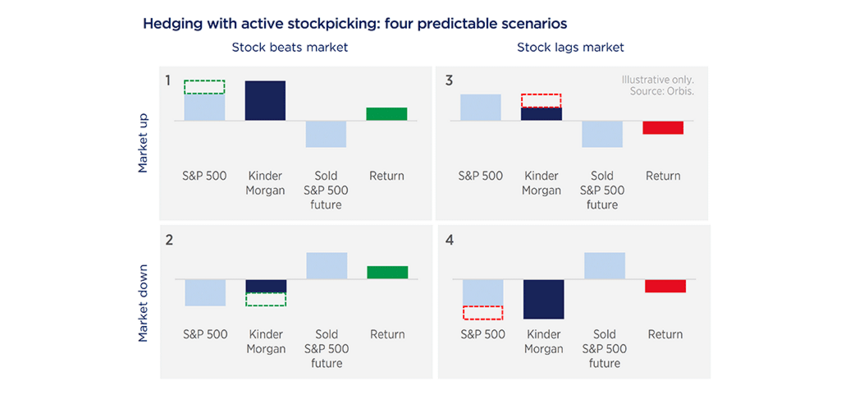

Far from being opaque, buying a stock then selling the market in equal amounts always results in just one of four simple scenarios. Let's use US-listed Kinder Morgan and the US' S&P 500 Index as examples:

Source: Orbis Investments, for illustrative purposes only

In the first example, the S&P 500 produces a 10% return, and Kinder Morgan a return of 15%. Shorting the market means that we don't get to participate in the market gain, so the return of the combined position would be 5% (15% minus 10%). When the market is up, hedging can reduce returns. However, hedging can be beneficial if the market is down.

In the second example, the S&P 500 loses 10% and Kinder Morgan loses 5%. While Kinder Morgan was down, it was down less than the market, and because we were short the market, the gain from the hedge more than offset the stock's decline, resulting in a positive 5% return. Importantly, the key driver of performance is the difference between the stock's return and that of the market, i.e. the alpha. That's true whether the market is up or down, and whether the stock beats or lags the market.

Examples 3 and 4 illustrate this point—irrespective of an up or down market, poor stock selection will produce a negative return. What matters most is not the return of the market or the return of the stock, but the difference between the two and the extent to which the stock does better (or worse) relative to the local market.

In addition to isolating stock-specific returns, hedging with index futures also generates a small, cash-like return—a helpful by-product of how futures are priced, particularly when interest rates are high.

Why use hedging?

1. It helps to reduce portfolio risk

Stockmarkets can suffer substantial drawdowns, and even if you're not worried about a crash, stocks have plenty of volatility. Hedging lets us reduce overall market exposure in a measured way, while keeping exposure to the performance of companies we find attractively priced.

Hedged equity proved particularly helpful in 2022, when both equity and bond markets declined sharply, and in early 2020 during the Covid-driven downturn. In both cases, stockmarket hedging helped reduce the impact of broader market losses, by providing meaningful downside protection.

2. It helps us to target relative value

Expensive markets aren't necessarily devoid of value, investors just need to be selective. A good example today is the US—in aggregate, we believe the US market is expensive and, we are not particularly optimistic about its future returns given today's starting valuations. However, that's not to say it lacks attractive individual opportunities. We've found several compelling stocks —including pipeline operator Kinder Morgan, theatre chain Cinemark, and semiconductor manufacturer Micron—among others.

We don't want to avoid these opportunities simply because a failing US market could drag down their performance. Instead, we invest in stocks we like and hedge the associated market risk, leaving us primarily exposed to their idiosyncratic performance relative to the broader US market.

3. It can serve as an attractive alternative to bonds

While hedged equities and bonds may be similar from a volatility perspective, the drivers of their returns and their associated risks are completely different. That makes hedged equity an attractive lower-risk option for a portfolio at times when bonds look risky and unattractive.

An integrated approach works best

We don't know what the market will throw at us over the long term, so we want to have the flexibility to keep capital invested in attractive assets across the cycle, while maintaining a risk level consistent with our Funds' mandates. We believe hedging is one tool that helps us do just that.

Disclaimer:

Capital at risk.

Approved for issue in the United Kingdom by Orbis Investments (U.K.) Limited, which is authorised and regulated by the Financial Conduct Authority. Orbis Investments (U.K.) Limited is incorporated in England & Wales under company number 8138002. Registered office address: 28 Dorset Square, London, NW1 6QG.