Key points

- Duration risk has fallen relative to pre-Covid-19 levels, meaning the risk of a drawdown in global bond markets akin to what we saw in 2022 has reduced.

- The UK bond markets has been particularly volatile, owing to the changing interest rate outlook, but long-term investors stand to gain from an improved return outlook.

- Multi-asset investors should embrace duration risk, as attempting to tilt their bond portfolios towards shorter-duration bonds can potentially limit their long-term return prospects.

While policymakers worldwide have continued to hike rates in the battle against persistent inflation, bond market volatility has persisted following a tough 2022. Nevertheless, investors shouldn't allow recent bond market volatility or the sell-off in 2022 to cloud important long-term asset allocation decisions: in our view hedged global bonds remain one of the most reliable long-term diversifiers to equity market risk.

What's more, higher interest rates mean the return outlook over the long run has improved for investors in bonds, which in turn is good news for long-term investors in diversified multi-asset portfolios.

The challenge facing advisers and investors is the tendency for losses (negativity bias1) and recent experiences (recency bias2) to have an outsized impact on their decision-making - including investment portfolio decisions.

The question investors should ask is: will the next five or 10 years in bond markets be like the past 18 months? Our analysis suggests this is unlikely.

That's because the catalyst for last year's annus horribilis in global bond markets has been a sharp upswing in interest rate expectations, with duration risk exacerbating the problem. Meanwhile, in the UK, bond market volatility has continued in 2023.

The role of duration risk in bond performance in 2022

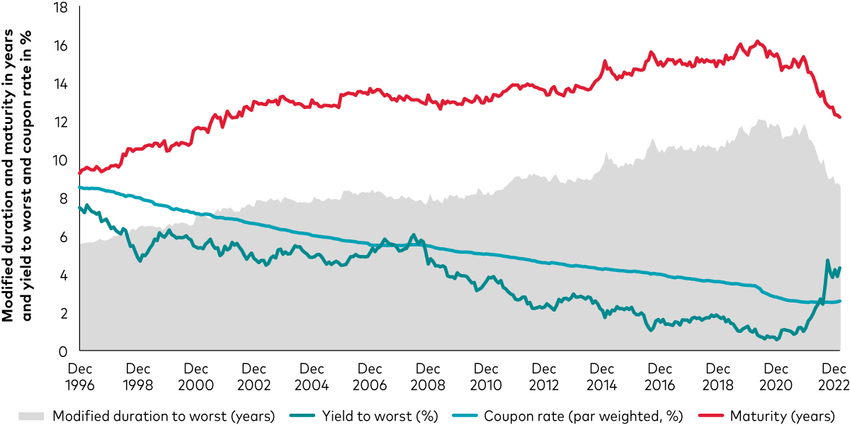

Duration risk refers to a bond or bond portfolio's sensitivity to interest rate changes, accounting for characteristics such as yield, coupon rate and maturity. Bond prices move inversely to changes in interest rates, so that if interest rates rise (or fall), bond prices fall (or rise). The longer a bond's duration, measured in years, the more sensitive its price to interest rate changes. As the chart below illustrates, duration (the shaded area) had been rising steadily since the mid-1990s before accelerating in the aftermath of the global financial crisis (GFC).

The explanation for this trend is two-fold. First, the exceptional monetary stimulus instigated by central banks after the GFC drove yields on short- and long-dated bonds down to historic lows. Second, bond issuers at the time saw an opportunity to refinance old debt by locking in the lower borrowing costs for longer (100- and 50-year bonds were issued in Europe as recently as 2021), effectively extending maturities and the repayment of principle.

Ultimately, amid the ultra-low interest rate environment, supply was met with demand as investors were willing to take on increased duration risk in the hunt for yield.

Duration risk steadily built up - then rapidly unravelled

Source: Bloomberg, Vanguard. Notes: Broad GBP bond market represented by the Bloomberg Sterling Aggregate Index. Data from 31 December 1996 to 28 February 2023. Modified duration to worst refers to the duration of a bond calculated using the nearest call date or maturity, whichever comes first. Yield to worst refers to the lowest possible yield that can be received on a bond (accounting for callable bonds). Coupon rate (par-weighted, %) reflects average coupon for new bond issuances. Maturity refers to the time left before the bond issuer repays the principal investment.

As central banks raised rates faster than expected in 2022 to combat rising inflation and cut short their bond-buying programmes, bond yields soared and prices fell, with bonds with a longer duration the most impacted.

The important point for multi-asset investors to bear in mind here is that duration risk is now significantly lower relative to pre-Covid-19 levels and the likelihood of drawdowns in global bonds akin to those seen in 2022 has reduced as a result3.

Why has the UK bond market been especially volatile in 2023?

While volatility in many major bond markets has lessened since 2022's fixed income sell-off, the UK market has experienced ongoing turbulence into 2023. This is partly because the UK faces particular inflation challenges. At the beginning of the year, bond markets had priced in a peak rate of 4.7% in the UK and expected the Bank of England (BoE) to start cutting rates before the end of the year in anticipation of falling inflation and a (still) likely recession. Fast-forward to June this year and the picture had already changed significantly following a flow of surprising UK economic data, including a rise in year-on-year core inflation in May and June.

As a result, UK bond prices have been more volatile relative to other markets because investors have had to adjust their UK rate outlook. We now expect the BoE's bank rate to peak between 5.5% and 5.75%.

A compelling case for long-term bond investors

Broadening our focus to global bond markets, volatility may continue in 2023 while the macroeconomic environment remains uncertain. Some investors might be tempted to deliberately tilt their bond exposures towards short-term bond funds or cash, given the yields available on short-dated debt and reduced sensitivity to interest rate changes.

The problem with this approach is that investors will at some point want to switch back to longer-duration bond funds before markets price in rate cuts. That's because, as we explore above, long-duration bonds tend to benefit when interest rates fall, while short-duration bonds don't. However, it can be very difficult for investors - even professional investors - to time the market in this way.

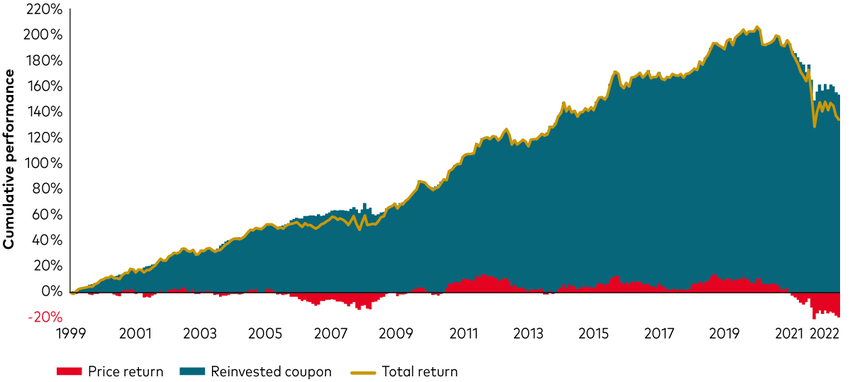

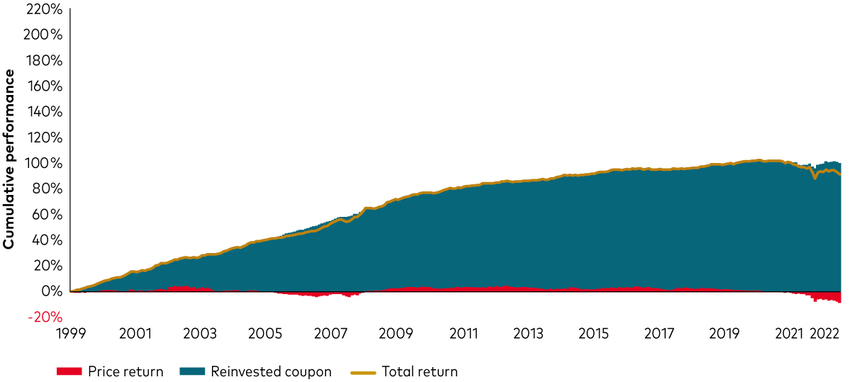

The next two charts break down the total return of long- and short-duration UK aggregate bonds over nearly a quarter of a century and highlight how bearing some duration risk can pay off for investors over the long term. The data show that income return (green), when reinvested, compounds over time and drives the majority of total bond market returns - and also that the higher coupons offered by higher-duration bonds have powered outperformance versus short-duration bonds, which pay lower coupons.

The red-shaded areas illustrate the contribution of price return to total bond market returns. This shows how any investors attempting to tilt their bond portfolios towards shorter-duration bonds are potentially limiting their long-term return prospects, especially in environments of declining interest rates.

Total return analysis of long- and short-duration UK government bonds

Past performance is not a reliable guide to future returns.

Source: Vanguard calculations, based on data from Bloomberg. Data between 31 December 1999 and 30 June 2023. Notes: UK aggregate 7-10Y returns based on the Bloomberg Sterling Aggregate 7 to 10 Years TR Value Unhedged index. UK aggregate 1-3Y returns based on the Bloomberg Sterling Aggregate 1 to 3 Years TR Value Unhedged index. Returns calculated in GBP with income reinvested.

Ultimately, the main role of bonds in a long-term multi-asset strategy is to provide diversification against equity market risk. In our view, investors are unlikely to experience another drawdown in global bond markets of last year's magnitude and—in the case of the UK government bond market—recent volatility does not detract from the long-term investment case of holding UK bonds as part of a diversified multi-asset portfolio.

For more information on the dynamics of stock/bond return correlations, including in a scenario whereby stocks and bonds are positively correlated over longer time frames, click here.

1 See Kahneman and Tversky, 1979. 2 See Barberis et al., 2001. 3 Source: Vanguard, 2023.

More clarity for your clients

LifeStrategy® funds and model portfolios

Five choices for low-cost, uncomplicated all-in-one access to global equity and bond markets, available in funds and model portfolios, meaning more time for advisers to spend with their clients.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.