- China has traditionally favoured production and investment over stimulating consumer demand, which has led to overcapacity and the potential for deflation.

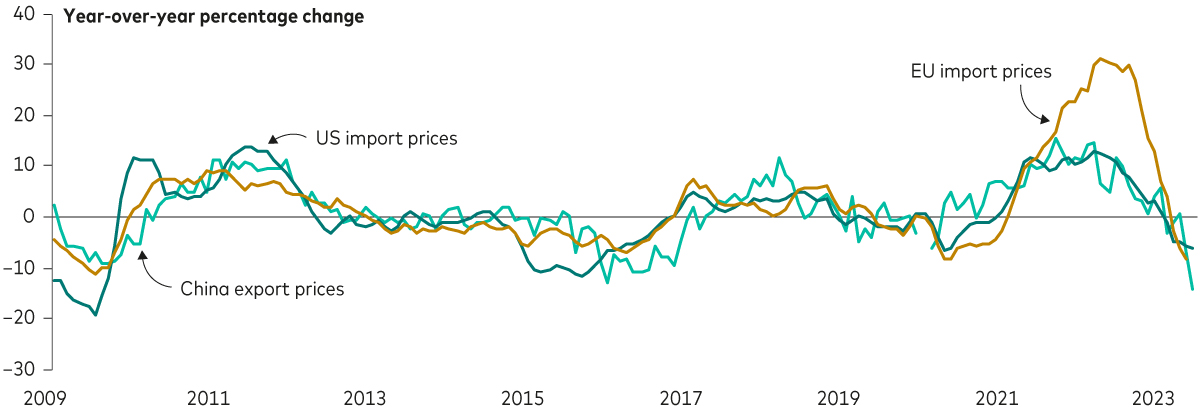

- China's exports have also helped keep down import prices for other countries.

- While the next 10 years is likely to be more challenging for economic growth in China, Chinese equities look undervalued.

China has powered much of the world's economic growth over the last four decades. Today, its own economy faces considerable challenges. In this article, Vanguard's chief Asia-Pacific economist and global head of the Vanguard Capital Markets Model (VCMM), Qian Wang, and senior investment strategist Grant Feng, explore the potential economic and investment implications of the outlook for China and, critically, why China's economy is unlikely to suffer the same problems that beset Japan's during the 1990s.

Why is China's economy struggling?

The pent-up demand, especially for services, that was unleashed earlier this year when China reopened its economy after extended Covid-19 lockdowns faded quickly. Weak fundamentals and structural headwinds are causing the economy to grow much more slowly than we previously expected, while significant economic uncertainty is constraining not only households but the private sector too.

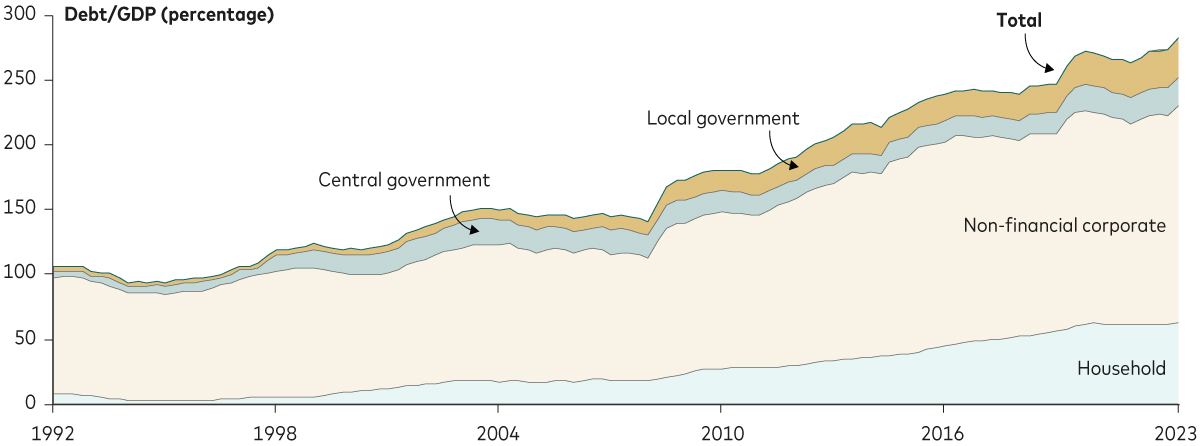

Despite this backdrop, policymakers are hesitant to forcefully stimulate the economy given debt levels that have grown steadily in the last decade. Overinvestment in the property sector has led to increased debt loads, not only among private developers but also among households and local governments.

What have policymakers done to support the economy?

Policy stimulus has been focused on cutting interest rates, making it less expensive to borrow. But right now, the bigger issues are weak fundamentals and weak confidence. Chinese households have had three years of low income growth, and unlike Covid-19 response policies in much of the developed world, there has been limited government income and employment support.

Housing prices have declined sharply and there are deep challenges in the property development sector; the decline is especially significant as 60% to 70% of household wealth is concentrated in real estate, based on our estimates. Household debt has risen sharply over the last 10 years and the labour market is weak. So, firstly, people don't have much money at their disposal, and secondly, they don't have confidence about the future. So even if the cost of capital is low, they don't want to borrow - in other words, there is no credit demand.

Further, both business and consumer confidence is low. The average household's debt-to-income ratio has exceeded that of their US counterparts, based on our estimates. Local governments, which historically have borrowed and spent money on infrastructure to stimulate the economy, are constrained by property values that have fallen the last two years, meaning they don't have the resources or incentive to invest further. Given this backdrop, the effectiveness of any monetary policy easing will be discounted.

China's debt ratio has increased significantly

Source: Vanguard calculations, using data from CEIC and Wind. Data from 1 January 1992 to 31 March 2023.

How has China supported the economy historically?

China has long favoured production and investment, instead of directly stimulating near-term consumer demand through consumption vouchers or providing consumers with cash. But this approach can bring an unintended consequence.

In the US, for example, the focus has recently been on spurring consumer consumption and the consequence is inflation. In China, with its emphasis on production and investment, the consequence has been overcapacity and an increased potential for deflation, which in fact occurred in July, when broad consumer prices fell compared with a year earlier.

China has in essence exported deflation to the rest of the world. Since it joined the World Trade Organization in 2001, China's export price inflation has hovered around zero, which has helped keep down import prices for other countries. So far this year, the reopening of China's economy has been a key force of global goods disinflation, given the country's significant build-up of inventory and production capacity during the pandemic, notable renminbi depreciation, and weak demand for goods from Western consumers.

China has been exporting deflation to the rest of the world

Sources: Vanguard calculations, using data from the People's Bank of China, China's General Administration of Customs, the U.S. Bureau of Labor Statistics, and Eurostat. Data from 1 January 2009 to 31 July 2023.

Inflation in general could have been far greater if it wasn't for the overcapacity and deflationary pressures in China. We expect this tailwind for the global economy to continue in coming quarters.

What is the likelihood that China will follow the experience of 1990s Japan?

When we analyse the demographics, the real estate market and the financial risks, there are similarities to Japan, where economic growth stagnated for three decades after its equity and real estate bubbles burst. The chance of a Japan-style stagnation is elevated in China.

Though some recent high-profile developer defaults are worrisome, we would highlight a key difference between China and Japan. China has a very strong central government that will do what it takes to avoid a Minsky moment1. It will likely be a three-step process: One, China maintains strict capital controls; two, the central bank continues to inject liquidity into banks, most of which are state-owned; and three, banks continue to roll over companies' debt, minimising the prospect of a systemic crisis.

China has been proactive in containing potential spillover, helping to ensure near-term stability. But this could come at the expense of efficiency. Some property developers may exist only to continue to pay interest on their debt. This would weigh on productivity growth and broad economic performance, raising the risk of stagnation in the long term. The property sector will likely remain a drag on the economy in the medium term, rather than the growth engine it once was.

There is another big difference between the conditions of today's China and those of Japan in the 1990s. China still has a huge domestic market, notwithstanding what's going on with real estate. Foreign direct investment did plunge to a 26-year low in the second quarter of this year, but companies from Europe and some emerging market countries are still investing because they see untapped opportunities, particularly on the consumption and services side2.

What are the implications for investors?

Our research shows that the long-term equity market outlook has zero correlation with long-term economic growth. Macro views do not necessarily translate to future expected returns. If we all expect that the economy will grow more slowly in the future, that has already been priced into the market.

Valuations for China are depressed right now because they have priced in not only lower long-term growth but also policy risk, financial risk and geopolitical risk, which are significant. Though further downside is possible, at this level the median of our projected range for annualised returns over the next 10 years for Chinese equities is greater than 8%.

That's why we think investors would be sensible to maintain an exposure to Chinese equities as part of a globally diversified portfolio of stocks and bonds, which remains an effective strategy in helping clients achieve long-term investment goals.

The Vanguard Tough Mudder Takeover

For one day only, Vanguard will be taking over the famous Tough Mudder 5km course, to bring you, your colleagues and your peers an active day out like no other. Featuring 13 teamwork-inspired muddy obstacles jam-packed into one action-packed course, challenge yourself and your colleagues and make The Vanguard Tough Mudder Takeover your next team day out. And the best part? It's all on us.

Notes:

1 Named after economist Hyman Minsky, the "Minsky moment" refers to a market collapse after an unsustainable speculative bubble fuelled by accumulation of debt. The collapse of Lehman Brothers and the ensuing global financial crisis is an oft-cited Minsky moment.

2 Based on CEIC data as of 30 June 2023.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.