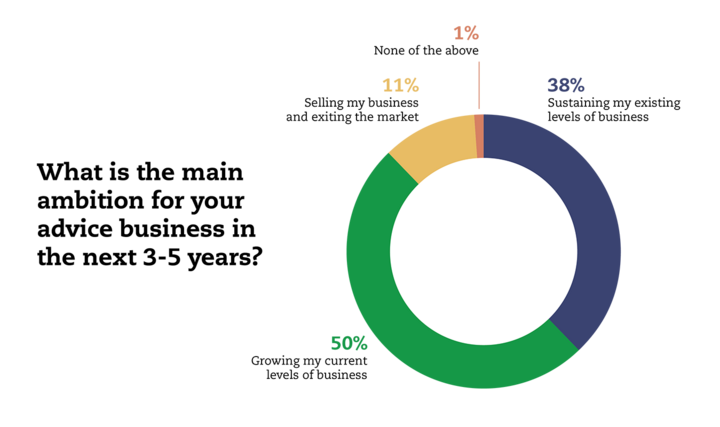

In our latest survey ran in partnership with Quilter Financial Planning, we found that half of advisers - some 50% - would like to grow their customer base over the next few years. 38% will be treading water - sustaining their existing level of business, and a further 11% will look to sell their business and exit the market.

Given the oft-reported average age of an adviser as rapidly approaching - or at - what most think of as ‘retirement age' the desire to sell up for some is unsurprising.

An advisers' age isn't the only focus here- one study placed the age of a substantial chunk of advised clients as high as 70[1]. And that matters: when it comes to calculating the value of an advice practise, the average age of the client base exerts a powerful influence on the valuation of the business: the younger the clients, the greater their need for ongoing advice, the greater the value of the practise over time. This is important not just for the 11% who are planning to sell up now, but also for every business owner who hopes one day to make an exit by selling - after all, it's not only client retirements that need to be planned for.

This creates something of a structural tension: older clients tend to have more money, a correspondingly greater need for advice, and are thus quite simply more lucrative for the adviser (we delved into the maths of this recently*). An individual adviser can only service so many clients - why focus on those who are less valuable when you have a ready pipeline of those that are, or you're already working at capacity? As one adviser told us "I do not want younger clients, we focus on the more wealthy and complex cases".

Advisers need to keep an eye on this tension to avoid disappointment when the times comes to sell their business - when it will be too late to fix the problem. If you haven't factored in the age of your client base when calculating its value, then your sums may well be flawed.

Winning younger customers

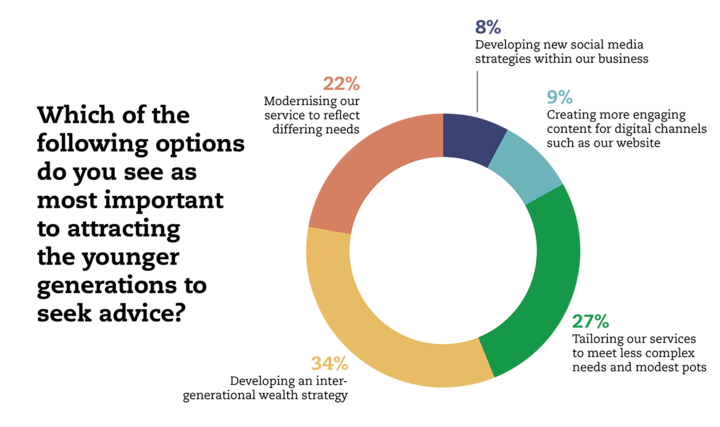

Just over a third of advisers think the best way to establish a younger client base is via an intergenerational wealth transfer strategy; effectively by following their clients' wealth as it changes hands at the point of inheritance. Just shy of a quarter look towards modernising their service to reflect the needs of younger customers.

This adjective; the oldest millennials are now in their 40s[i] - not what most people would understand by "young") - as fundamentally different. The digitally native generations are far more likely to research investment solutions online than immediately seek advice, or likely to think they can manage themselves after a single advice session a "tendency to pick your brains and then go online" as one adviser told us.

Advisers would like to see more education around financial wellbeing and retirement planning at an early age - there is a strong consensus that an understanding of the financial system and retirement planning in general perhaps ought to be on the curriculum in schools and universities.

In the absence of that, many advisers see a value in educating younger customers themselves - positioning themselves to benefit from the changing client behaviours of those born into the online world. This means picking up on modern content and social marketing techniques: providing educational content online that helps customers understand issues and risks, that can build trust in the value of your advice and spreading the word using social media. Reflecting the behaviours of younger customers and swimming with the modern tide.

In doing so these advisers are gearing up for the next generations' desire for a "low touch" service, replacing in-person with digital meetings, using online content to get customers up to speed before those meetings, and potentially finding that, whilst younger customers have less to spend, you can potentially serve more of them.